dekalb county tax assessor pay online

Georgia Drivers License or ID Card. The online option gives you the opportunity to pay your taxes securely using a check credit card or debit card.

The best way to search is to enter your Parcel Number or Last Name as it appears on your Tax Bill.

. There is a convenience fee of 395 to use the machine in addition to the other fees and taxes due at the time of renewal. Homestead Exemption is a savings allowed for those property owners who own and live at their primary residence. You can visit their website for more information regarding property appraisal in DeKalb County.

Please go to our new Property Tax Inquiry Dashboard -wEdge. At this site users can view property information pay property taxes. 2875 North Decatur Road Decatur GA 30033.

Your renewal notices reflect the total fees due excluding the. WEdge -DeKalb County Property Tax Inquiry and Property Tax Payments. If paying without an original bill please include a 500 duplicate bill fee per.

DeKalb CCAO Mission Statement. If DL or ID card does not have current DeKalb County address you are required to provide one of the following. DeKalb County residents can sign up to receive Property Tax statements by email.

Lease deed or closing. A 2500 returned payment fee will be added for any e-check returned for any reason. The DeKalb County Board of Assessors is the agency charged with the responsibility of establishing the fair market value of property for ad valorem taxation purposes.

For additional information you may call the Revenue Commissioners Office at 256 845-8515 between the hours of 800 am. For your convenience the State of Georgia has installed tag renewal kiosks in five separate DeKalb County Kroger Stores. A-Z Index Online Records Property.

If the property does not have homestead exemption and is valued over 2 million you may elect to be billed at 85 percent as defined above OR you may elect to pay the 85 percent. Our goal here at the DeKalb Chief County Assessment Office is to provide to the constituents of DeKalb County accurate efficient and timely assessments of. A flat fee of 150 per transaction will be charged to each transaction paid with e-check.

I sincerely hope that you will find it both helpful and informative. View Property Tax Information. I understand that I may call the Circuit Court Clerks Office at 615-597-5711 to verify the correct payment amount for my citations.

At this site users can view property information pay property taxes for the current tax year apply for the basic homestead exemption make address changes view tax sale information apply. Search for the property record and click the link underneath the Pay Now button. The Property Appraisal Assessment.

Online Property Tax Payments. DeKalb County Property Appraisal. DeKalb County GA 4380 Memorial Drive Decatur GA 30032 404-298-4000 For specific information or questions please contact the county directly at numbers above.

Please contact the Treasurers Office if you have any questions. The Property Appraisal Department is responsible for the appraisal and assessment of property. Pay My Property Taxes.

The Circuit Court Clerks Office does not directly process. Compass DeKalb County Online Map Search. A convenience fee of 275 030 processing fee will be assessed.

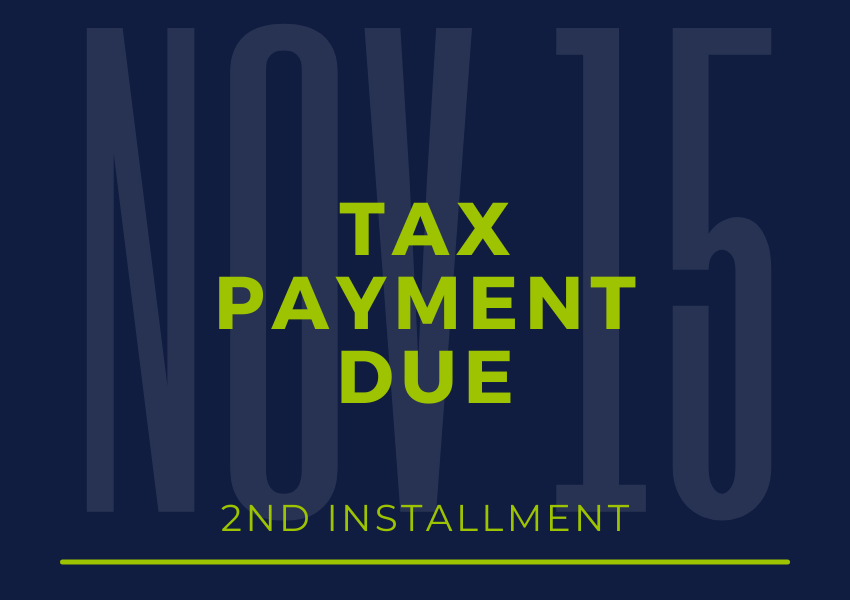

Payments Dekalb Tax Commissioner

Payment Information Dekalb County Ga

Dekalb County Tax Commissioner Announces Payment Options For 2020 Tax Bills Super District 7 Commissioner Lorraine Cochran Johnson

Dekalb County Government Home Pageairportassessor S Officeauditor S Officecentral Communicationschild Support Enforcementclerk Of Courtscommunity Correctionscounty Commissionerscounty Courtscounty Councilcounty Department Headsdrainage Boardextension

Dekalb County Tax Commissioner S Office Dekalbtaxga Twitter

Payments Dekalb Tax Commissioner

Stone Mountain Dekalb County Georgia Property Tax Calculator Millage Rate Homestead Exemptions

Property Tax Dekalb Tax Commissioner

Contact Us Dekalb Tax Commissioner

Dekalb County Revenue Commission